Employees of private schools and universities can now take advantage of personal restaurant meals and entertainment as a fringe benefit.

It might surprise you to know that as an employee of a private school or a not-for-profit university, you can access a fringe benefit for private meals and entertainment of between $2,403 and $16,825 per year. This also includes hiring a venue for that all important 50th birthday celebration or wedding.

What is Meal Entertainment?

Meal Entertainment refers to salary packaging any sit-down meal out for 2 or more people, including drinks. The facility hire and catering for entertainment, as well as the provision of a band or DJ is also regarded as entertainment and can be packaged. Meal Entertainment is a fringe benefit and is not work-related.

Put simply, Meal Entertainment allows you to save thousands per year on private dining out and events.

To qualify, Meal Entertainment should comply with the following broad points;

- It should be provided outside of work in a social situation;

- It should be provided outside of working hours;

- Meals should be more formal by nature (coffees and take-outs are not included);

- It should be provided at a function room, hotel or restaurant;

- It can include Entertainment Facility Leasing;

- A private box at a stadium or similar venue;

- A boat or plane for the purposes of providing entertainment;

- Venue hire (weddings, 50th party, etc.) for the purpose of providing entertainment;

- Recreational entertainment like tickets to sporting or cultural events, green fees and hiring a band or entertainer.

Who are NFP Rebatable Employers?

NFP stands for not-for-profit. Generally, private schools and universities operate as NFPs and are classified as Rebatable Employers by the Australian Tax Office. This gives you access to a discount on fringe benefits tax of up to $16,825 of spend per year, for meal entertainment.

Who qualifies for Meal Entertainment?

Any employee of a NFP Rebatable Employer qualifies for using the Meal Entertainment benefit. By salary packaging the Meal Entertainment, you can save between 10% and 22% of the amount you spend on Meal Entertainment.

How much Meal Entertainment can I salary package?

If you already salary package other benefits, you may only be able to package actual spend of $2,403 per year;

If you don’t package other benefits, you can package an additional $14,422 per year.

Why has this not been available before?

Traditional payment cards cannot administer the data required for providing the fringe benefits. We have developed technology that enables us to accurately report and manage Meal Entertainment for NFP Rebatables.

Why has this not been available before?

Traditional payment cards cannot administer the data required for providing the fringe benefits. We have developed technology that enables us to accurately report and manage Meal Entertainment for NFP Rebatables.

Why should I use Entertain@bility’s new meal entertainment technology?

Simply put, our competitors are still using old meal entertainment card technology, which does not allow you to track ABNs or GST, or meet the compliance requirements for retaining tax invoices.

Our systems:

- Are compliant

- Track ABNs

- Track GST

- Are easy to use

- Save you time

There is no set-up fee and our service costs you nothing; we only charge you 15% of what we save you, paid for out of your savings.

How do I go about securing these benefits from my employer?

Simply get your employer to contact Entertain@bility and we can “set the meals in motion.”

If I pay more tax, does this mean that I can save more?

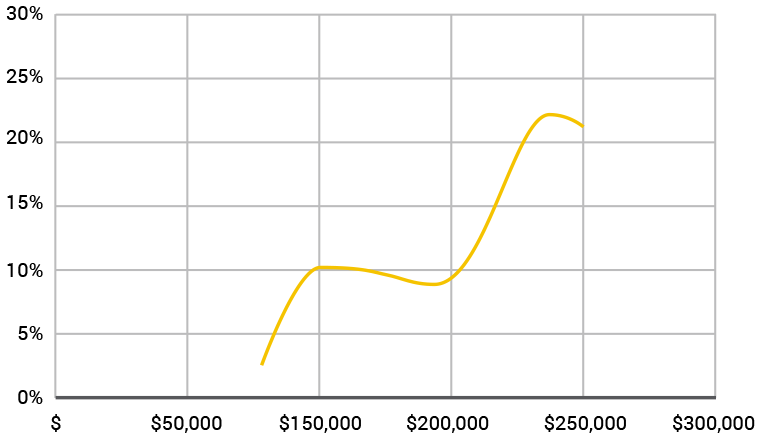

Yes, the higher your tax rate, the higher the amount of savings you can expect. This is because you pay 37c in each additional $1 past $90,000 and 45c in each $1 past $180,000.

At $90,000 per year, you can save 10%.

At $180,000 and above, you can save 22%.

Expected % Savings to Gross Annual Salary